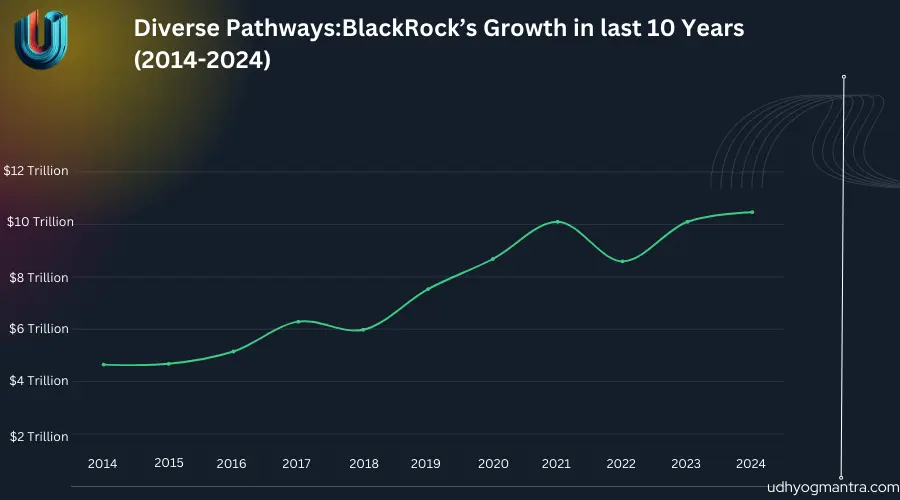

BlackRock, Inc. (founded in 1988) is the biggest investment management firm worldwide with nearly 9 trillion dollars under management. The firm has established itself as a leader in the investment management industry, known for its well-planned investment strategies, technology-based problem-solving practices, and a strong focus on clients. Learning about the business management and strategy of BlackRock gives us an understanding of how the company has been able to maintain its leadership position among its competitors in the financial services industry.

Inside BlackRock: Winning Strategies That Drive Unrivaled Success

BlackRock’s strategy has four elementary factors:

(a) Global Reach: Client Portfolio’s investments incorporate a variety of asset classes such as equities, fixed income, alternatives, real estate, and many more. This way the firm minimizes any risks brought about by the volatility of an economy by spreading out to various markets and sectors. It also has an additional core location that helps the company remain strong even amid fluctuations in the market.

(b) Focus on clients: A cursory look at the background of BlackRock would disclose that it has a passion for servicing its clients. Its customized services are directed at professional clients such as pension and sovereign wealth funds as well as ordinary consumers. This is fundamental in the scope of the company as it enhances performance targets: define and achieve the goals of the clients in detail.

(c) Innovation and IT: Technology has transformed the process of investment management and BlackRock is at the forefront. Aladdin® is one of the most advanced systems which is used by this firm for risk management. This makes Blackrock stand out from other conventional asset management companies.

(d) Sustainability and ESG Integration: BlackRock is committed to making sure that the investments are made towards ensuring the environmental, social, and governance (ESG) policies. CEO Larry Fink has voiced concern over investing for impact and the same drives BlackRock to influence the businesses it funds to operate sustainably. This embrace of ESG allows BlackRock to remain in the game as the demand from the clients concerning investment patterns changes to embrace sustainability.

The Inspiring Leadership Driving BlackRock’s Unstoppable Growth and Success

Larry Fink is the CEO of the investment management company BlackRock and a co-founder of the company. Larry Fink’s vision has remarkably charted the growth of BlackRock; through his stewardship, the organization has experienced market growth, acquisitions as well as a change in direction. Thanks to his propulsion, Blackrock has been a leader in ESG capitalism amongst many other things, and offers the market a whole new level of scrutiny.

Fink has written aggressively and convincingly to CEOs outlining the case in favor of long-term including three-dimensional investments that are business-oriented, profitable, and beyond profit making. This turned BlackRock into a head of the financial machine as well as a proponent of corporate social responsibility.

Larry Fink’s Unwavering Commitment: How He Earned Client’s Love and Respect

An asset management giant, BlackRock incorporates every decision and the interests of its clients. It has a great passion for the financial security of the people. Their client-centric approach is very clear. It just not guides you only, But it is also a fundamental part of their business ethos. One can easily observe BlackRock’s commitment in the way it frames policy designs with client benefits at the front, covering what resonates within their interests, objectives, and feelings.

Using advanced technology, relevant information analytics, and knowledge of market trends, BlackRock develops investment plans that meet their clients’ specific needs and are in adherence to their lifetime objectives. It has offered direct visibility to the clients whereby they do not sit down and idly wait but instead engage in receiving and actively participating in the investment process. This instills confidence and encourages collaboration between clients of BlackRock and the company.

Also, environmental and social concerns have been put into consideration in BlackRock’s business practices as modern borrowers are conscious as to what the investment will yield in terms of society. Such adults have built policies that guide them in ethical investing and provide healthy alternatives that facilitate environmental stewardship, inclusion, and corporate citizenship.

Finally, a client orientation balanced with innovation in the formation of policies is precisely what has made BlackRock a familiar player in wealth management. It helps to improves and protect the client’s financial interests.

BlackRock’s Business Model: Where Innovation & Scale Meet

High on the value chain, BlackRock operates an intermediation and asset management business that incorporates technology and a multitude of consulting services. Most of the income is earned through the management of the trillions’ worth of assets that the company holds.

But in addition to these traditional fees, Blackrock’s revenue is highly enriched through Aladdin® and other technology services where it markets its risk management technology to financial institutions around the world.

The reliability of recurrent revenue about the performance fees and advisor fees applicable to promotions of Blackrock’s funds withstand the test of market seasonalities. Another strong aspect of BlackRock’s business is its iShares exchange-traded funds (ETFs), which allows Blackrock to be a great asset manager at inflows management even when equity markets are harsh on active management of the value of assets.

Why is BlackRock So Special?

BlackRock is arguably one of the largest but not the only ETF providers, the center of attraction being its iShares product line designed for retail as well as institutional clients.

The firm’s top position in the Niche of ESG Investing makes it different as it is more of an activist on sinking her portfolio companies to hold sustainable business approaches than most organization of investment management. This is not only attractive to a segment of the market which is now referred to as impact investors but equally is part of the changes that the society is keen on bringing about – the climate changes and improving Corporate Social Responsibility.

What’s more, managing risk and improving portfolio management have now become easier for BlackRock through its Aladdin® technology which it has invested in. The form has the advantage of not just focusing on human management but also incorporating the use of Artificial Intelligent Analytics that allows it to make forward-looking and market-forward solutions to its clients.

A Competitive Job Market: BlackRock Careers

It is difficult to get a job in BlackRock. it might be appealing since it is considered among the world’s leading companies, therefore many people will want to work there.

The recruitment is very competitive and the applicants not only have to prove their skills but also know a lot about the world, the industry, and the clients. It is also expected of them to possess incredible problem-solving abilities and even leadership and creativity. Take a look into BlackRock Careers opportunities.

BlackRock job offers in the area of corporate strategy attract the most attention among the applicants. Employees in such positions drive the firm’s strategy, conduct the market analysis, and work with Cape to develop strategies. They are at the forefront of BlackRock’s growth agenda by assisting the firm in embracing changes in the market while keeping a step ahead of its rivals.

Feedback and Future Outlook

BlackRock’s business strategy has an exceedingly potent nature and this explains why the company has been able to succeed within the dynamics presented by the international markets. Thanks to the company’s strategy its investments will always pay off for the investors no matter what the market looks like since it focuses on technology, sustainability, and relations with clients.

Moving on, the purpose of integrating ESG values into the business of BlackRock has, and will continue to have, a significant role in structuring the company’s strategy toward taking advantage of the development of the asset management segment. The company’s uniqueness in creativity not forgetting the corporate identity is what has put the company on top of the financial sector.

In conclusion,

it can be said that BlackRock’s approach to business and management strategy is based on the principles of diversification, a client-centered approach, innovation, and attention to sustainability — which is their win factor. With powerful and cohesive leadership, technology leverages, and practical perspective, BlackRock is a global icon ready for any growth energy.